‘ve spent the last 12 years studying, researching, and analyzing every facet of improving your credit score to the point that I could brag about attaining an 800, which many people consider to be a perfect number. Today, I’ll show you how to earn this identical achievement for free, and probably in a fraction of the time it took me to get my perfect score.

If you have a perfect credit score, you will be able to acquire the best interest rates on whatever loans you take out, whether in real estate or in life. It’s how I was able to get such cheap interest rates that it almost feels like I’m getting money for nothing. Not to mention, I’m so certain in what I’m saying in this video that if you just follow through, this information might be worth at least a few thousand dollars.

Understanding the Credit Algorithm

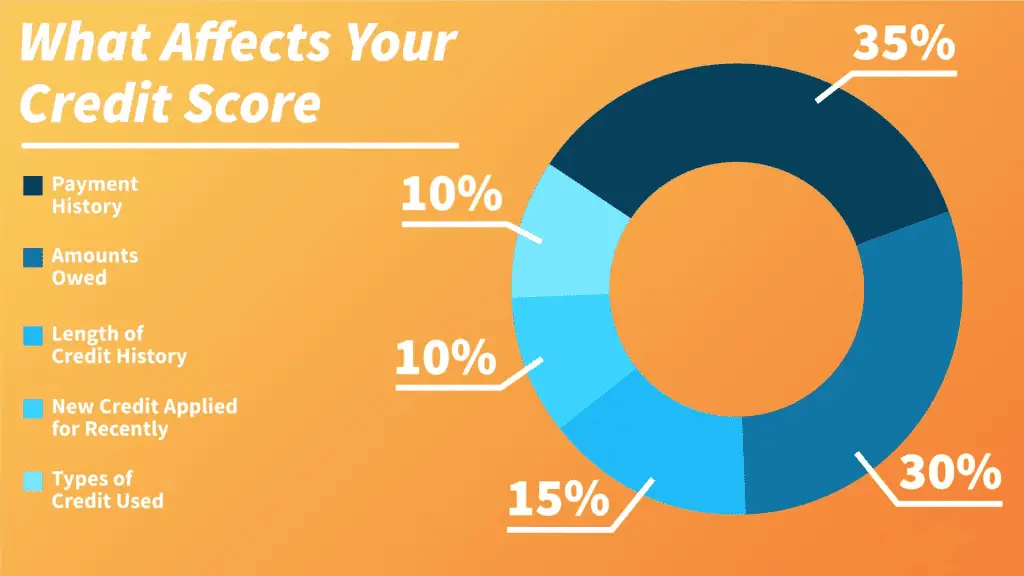

First and foremost, you must understand how the credit scoring system operates in order to comprehend how to obtain a flawless credit score. As I previously stated, just as your credit score evaluates you on a variety of criteria such as attendance, homework, and test scores, your credit score assesses you on a variety of things as well, and if you want to obtain a perfect score, you must do well on all of them.

The first and most important factor is your payment history, which accounts for 35% of your total score. This means that you always pay your payments on time, without ever being late or skipping a payment, since if you do, it will be on your credit record for seven years and will have a significant negative influence.

The good news is that in order to stay current on your credit card, you just need to make the minimum payment, which is usually between 25% and 50%, so even if you can’t pay off the entire balance, at least make the minimum payment. As a result, your account will remain in good standing.

Accounts Owed

The second most important factor is “amounts owed,” which accounts for 30% of your total score. This is also known as the utilization rate, and it determines how much credit you have available vs how much you utilize.

If you max out your credit cards or spend practically all of the credit that’s available to you, your credit score will suffer because you’re considered as a riskier borrower in this area. It’s critical to emphasize that the credit algorithms are concerned with the percentage of credit that you use rather than the total amount. For example, if you have a $1,000 credit line and spend the entire $1,000, you have a 100% utilization rate, which is really undesirable.

However, if you spend the same thousand dollars on a ten thousand dollar credit line, you’ll only be using 10 percent of your credit line, which is a positive thing. The third thing I do to help with this is to have a lot of credit accessible with very high limits. That way, even if I spend ten to twenty thousand dollars on a renovation, it’ll still still be a small portion of my total credit limit.

Age of Credit History

The third factor is the average age of your credit history, which accounts for 15 percent of your total score. Lenders prefer to see that you’ve had your accounts open and in good standing for a long time. The longer you’ve had your accounts open and in good standing, the more likely you are to be a good borrower.

Of course, you’ll notice that I indicated this is based on your average account history rather than your entire account history. If you created that same account four years ago but then acquired a brand new credit card today, your average account age would decrease to two years, lowering your credit score.

So, my advice is to start building credit as soon as possible, but also to keep those accounts open for as long as possible, as this will help you develop a good credit history foundation so that when you do open a new credit line, it won’t have as much of an impact.

Fourth, we have the different forms of credit you have, which factors for another ten percent of your score. Lenders prefer you to have experience dealing with various sorts of credit. This may appear to be backward thinking, but it is consistent with the belief that we should only lend money to individuals who don’t need it since they are the most likely to repay us, which is correct.

Finally, the number of cardiac enquiries on your report is used to compute the remaining 10 points. Every time you apply for a new line of credit, it’s noted on your credit report. The more marks like this on your credit reports, the lower your score will be since lenders will see you actively trying to get as much credit as possible, and you’ll be considered as a bigger risk.

Now that you understand how some of this works, here are several ways you may take to immediately improve your score to the renowned 800 mark. Of course, it’s all for free. To begin, sign up for a free account at either creditkarma.com or creditsesamy.com, which both provide you with all of the information of your credit history as well as your own credit rating model.

You may also acquire a free credit report once a year from annualcreditreport.com. By the way, if any website offers you to pay to access your credit score, simply click away because there’s no need in paying for something that is already free.

If that’s the case, you can start reading your report now that you have it to see what areas might be improved. And it’ll almost always be one of these initially. You don’t have sufficient credit. If you’re new to all of this and haven’t had much time to acquire a credit card and make on-time payments, your credit score will most likely be low because you haven’t had enough time to establish a credit history. If that’s the case, I’ll go over what you can do about it right now.

Collections

Any accounts or collections should be the fourth thing you look for. I’m not going to lie, if you see this well, it’s very horrible. For those who aren’t aware, this is what happens when you’re more than 180 days late on a payment and the lender simply gives up and declares the loan a loss.

The debt is then sold to a third-party collection agency, which contacts you incessantly in an attempt to convince you to settle the obligation. Collections under a hundred dollars usually don’t show up on the latest fico scoring algorithm, but regardless of how much money it is now, you’ll want to keep an eye on it.

Check to determine whether you have any big balances or credit lines that have been maxed out. This is what happens when you borrow or charge the maximum amount allowed by law, and lenders view you as a higher risk since why would you borrow that much money otherwise? This, in turn, lowers your score.

Furthermore, the popularity of purchase now, pay later services is showing up in your report, so if you thought buying the $3,500 peloton bike for $20 a month was a simple workaround, you might want to reconsider.

Bankruptcies and Foreclosures

Fifth, look at your credit history to discover whether there are any foreclosures or bankruptcies. This should be self-evident, but it’s surprising how often these marks are left on for longer than they should be, or people may have misinformation or have had their identity stolen without even realizing it, but once you know what’s affecting your score, you’ll be able to figure out the best way to improve it.

It’ll almost always be one of these. If you don’t have enough credit and want to improve your score right away, the most effective life hack is to become an authorized user. When someone with a long credit history adds you as an authorized user on their account.

This is when the credit history of someone else appears on your account. This is also known as credit piggybacking, because it allows you to benefit from someone else’s credit without having to perform all of the legwork.

There are, however, some caveats that you should be aware of because, as the saying goes, if it seems too good to be true, it probably is. The first snag is that some credit reporting companies are catching on, and the credit history will not be transferred to all three credit bureaus as a result.

As of now, it appears that Capital One, Discover, Wells Fargo, and Bank of America will record previous credit history, but other credit cards will only begin reporting history when you become an authorized user, which is exactly the same as acquiring a new credit card in someone else’s name.

The second snag is that because all of your past will be transferred to you, this will include late payments, delinquencies, and any other negatives. So make sure the person adding you is an authorized user with at least three to five years of credit history, no late payments, and everything in good standing; otherwise, you’ll be defeating the entire point.

Keep in mind that this isn’t a replacement for developing your own credit, but if you have someone willing to do this for you and pay down your accounts so that your utilization is under 10, it can assist greatly early on.

For the most part, I believe this will have the greatest impact on your score in the least length of time. Just keep in mind that the amount you owe, also known as your utilization rate, accounts for 30% of your score, so keeping a high balance on a credit card can lower your final number.

You have two possibilities in this situation. The first is to pay down your balance, which will normally result in a higher score in 14 to 30 days. The second is that, while it may seem contradictory, if you have an account balance you can’t pay off, it may be beneficial to create another credit card or boost your credit limit. This is because, as I previously stated, your credit use is determined by your entire credit line.

You could request a credit limit increase from your credit card company, which will lower your overall utilization and improve your credit score. Obviously, if you have a spending problem and these higher limits are what got you into trouble in the first place, don’t do it; however, if it’s purely tactical and you have the self-control not to just spend up the extra debt, increasing your credit lines or getting more credit cards may help you improve your credit score in the long run.

Experian Boost

The next method for improving your score is to use “experience boost,” which is a relatively new feature. Now here’s the deal: a big percentage of your credit score is determined by the number of on-time payments you’ve made, your overall credit history, and the types of loans you’ve received.

However, in a new credit scoring model, an experience bonus would certainly try to correct this. The vast majority of you would be eligible. This is not a paid advertisement. However, Experian Boost is a fully free opt-in service that connects your accounts and tracks on-time phone and utility payments by adding them to your Experian credit file as a positive trade line. This will help you establish a more positive credit history and restore on-time payments to your credit record.

So, for pretty much anyone trying to improve their credit and raise their score, I would strongly suggest this. Unless you don’t pay your bills on time, in which case you shouldn’t do it. But for everyone else, go ahead and do it.

Late Payments and Delinquencies

Next, clear your account of late payments and delinquencies. Remember that skipping a payment or being sent to collections will destroy your credit score completely, but all hope is not lost. A 90-day late payment, for example, will be far worse than a 60-day late payment vs a 30-day late payment, and so on.

Any late payments should be offset as soon as feasible. The more you wait, the worse it gets, so it’s a lot better now. Do not put this off because a 30-day late payment is preferable to a 60-day late payment. Third, it’s always worth attempting to renegotiate your loan conditions in order to bring your account current.

This implies you might contact the lender and see if you can work out a payment plan if you’re having trouble paying payments. The reality is that late payments are known for being charged off at cents on the dollar, so most lenders would prefer work with you to get something back than nothing.

If you paid off the bill but the late payment remains on your credit report, you may always phone them to see if they will remove it as a courtesy. To be clear, they are under no obligation to do so, although asking gently can sometimes go a long way.

If everything else fails, seek for inconsistencies in your report and dispute it. Again, you should never lie here, but if you see something out of the ordinary and they can’t prove it, they’ll be obliged to remove it from your report, so it’s worth a shot. Doing all of this should make a significant difference in your credit score in a relatively short period of time, so it’s possible that you’ll be able to achieve a perfect score.

Keep old accounts open indefinitely

The most common blunder I notice is that you should never close out your old accounts. The average age of your account history is used to determine your credit score. That usually begins with the age of your very first account, but if you close that oldest account because you no longer utilize it, you’re effectively eliminating your oldest trading line.

When this happens, the average age of your account history will reduce drastically over time. The general rule is that if they don’t say anything, they won’t say anything. If the card has an annual fee, simply charge a one-dollar Amazon gift card every six months or so, and then keep the card active for as long as feasible.

Consider reducing the card to a free alternative if it does have an annual cost. You can maintain your account history without having to pay for it in this way. This, along with ensuring sure your accounts are open and in good standing for as long as possible, will help you improve your score.

Be Aware of Credit Repair Scams

This is perhaps the most crucial item to pay attention to. Pay no money for credit repair services, and disregard all spam remarks congratulating someone on improving their credit score. The most of these are scams, and every time I try to delete one, a million more appear.

All of this is something you can accomplish for free in under an hour, and it is really simple to learn if you can follow these six steps. By paying off your credit card account in full using no annual fee credit cards, you can get a perfect credit score without paying any interest to credit card issuers.

It’s also worth noting that, while having a flawless 800 credit score is certainly a source of pride for lenders, anything above a 760 will normally get you the best prices and terms, as well as full red carpet service, so there’s not much of a difference between a 780 and an 800.

Following this, in their opinion, opens up a plethora of new options to save a lot more money than would otherwise be possible. If you found this information useful, please share it with others.